5

MM Development

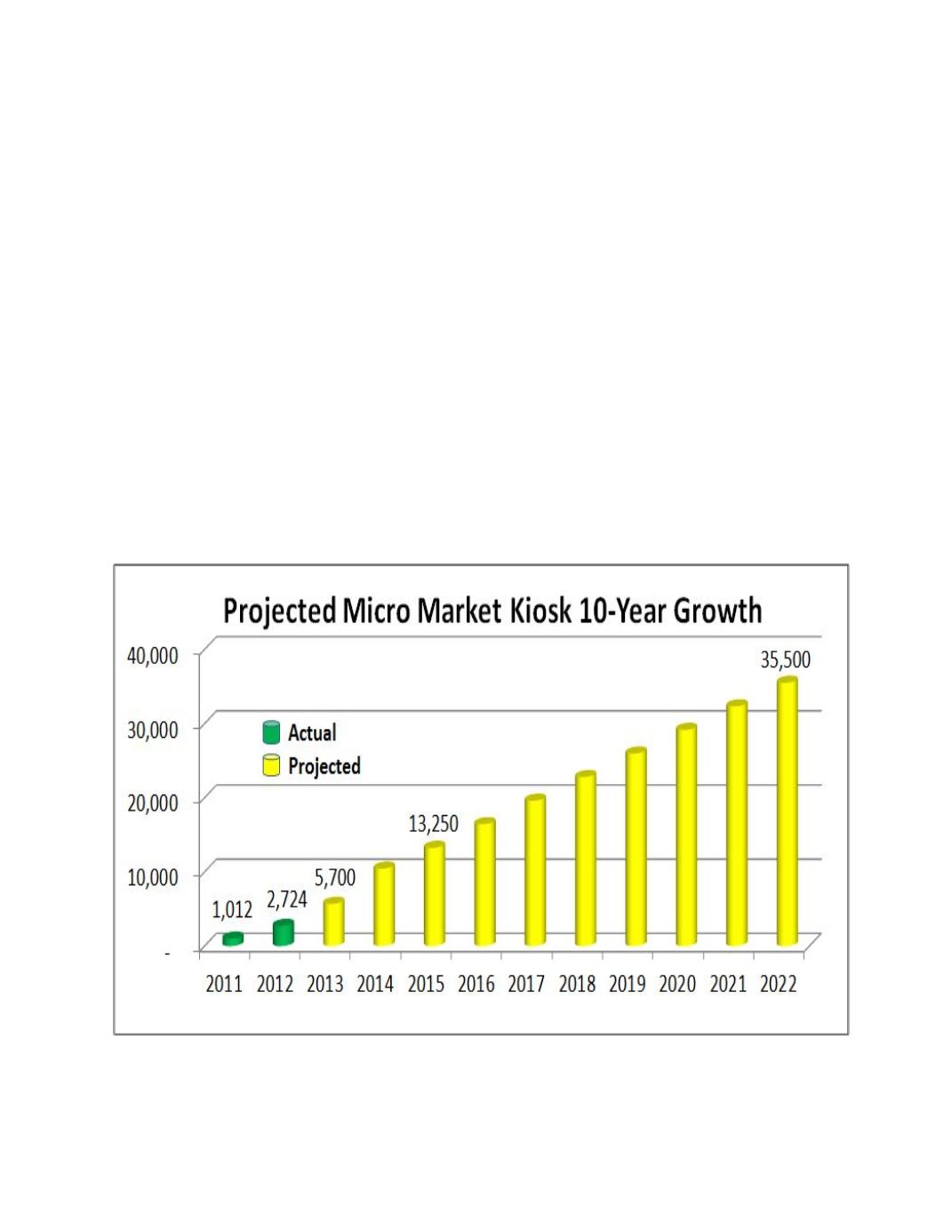

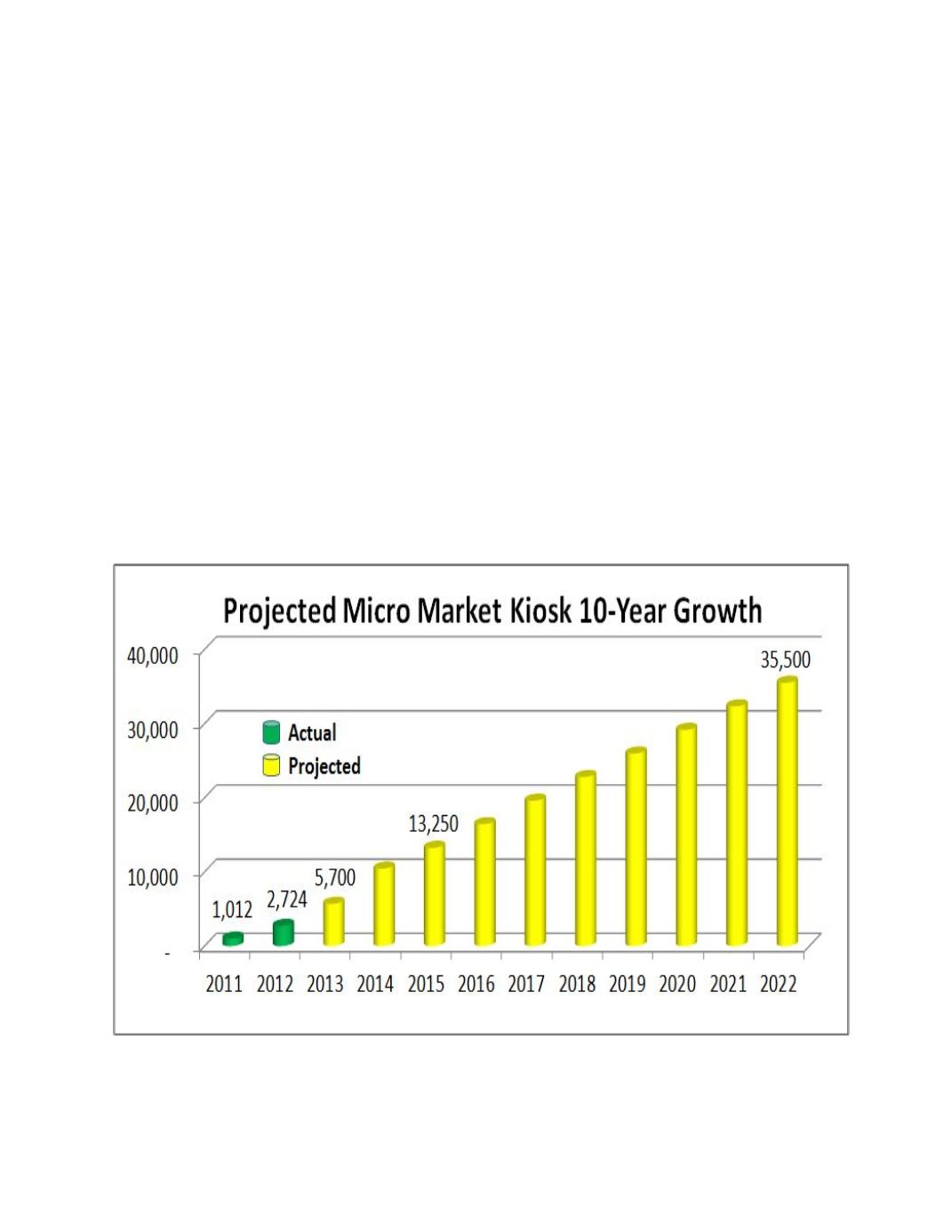

From 2011 to the end of 2012, the number of active Micro Market locations more

than doubled from 1,012 to 2,642. With a number of multiple kiosk locations, the year-

end active kiosk count equaled 2,724 (169% growth). Total 2012 Micro Market retail

revenues were $90.7 million; an average of $33,300 per year-end Micro Market location

count and $48,400 for markets installed for the full 2012 calendar year. Of the year-end

2011 install base, 56 Micro Market locations were removed from location during 2012; a

Micro Market turnover rate of 5.5%.

While the rapid Micro Market growth to date has been impressive, the next few

years are expected to experience an even greater rate of expansion. Based upon

equipment supplier projections, the size of the Micro Market install base is forecasted to

add more than 3,000 new locations each year through 2015 and to accelerate further

thereafter.

The following charts contain installed Micro Market census data through 2012

and supplier growth projections over the next ten years. In summary, the 2012 level of

2,724 active kiosks is projected to increase by 2022 to more than 35,500 kiosks

generating forecasted Micro Market revenues exceeding $1.6 billion (unadjusted for

inflation). Importantly, these significant growth projections primarily consider only

business locations and can be expected to be enhanced further by additional Micro

Market placements within hospitality, correctional, and other location segments.