54

QRCA VIEWS

SPRING 2016

www.qrca.orgthinking and process. I know…it doesn’t

feel fair. It’s not! But, this is the stigma

that the “market researcher” has in the

UX world today.

At this point you could say, “Well,

leave it be then. I’ll stay over here in my

Market Research world where I don’t

have to fight unfounded perceptions

about my worth and value as a profes-

sional.” While I certainly would not fault

you in that decision, I do know that you

would be turning your back on a growing

opportunity that you—as a market

researcher—have unique and differenti-

ated value to offer within.

The UX discipline is maturing. And

with that maturation comes a desire for

senior executives within Fortune 1000

organizations to utilize their UX-spirited

teams to inform strategic directions

endorsed by the organization.

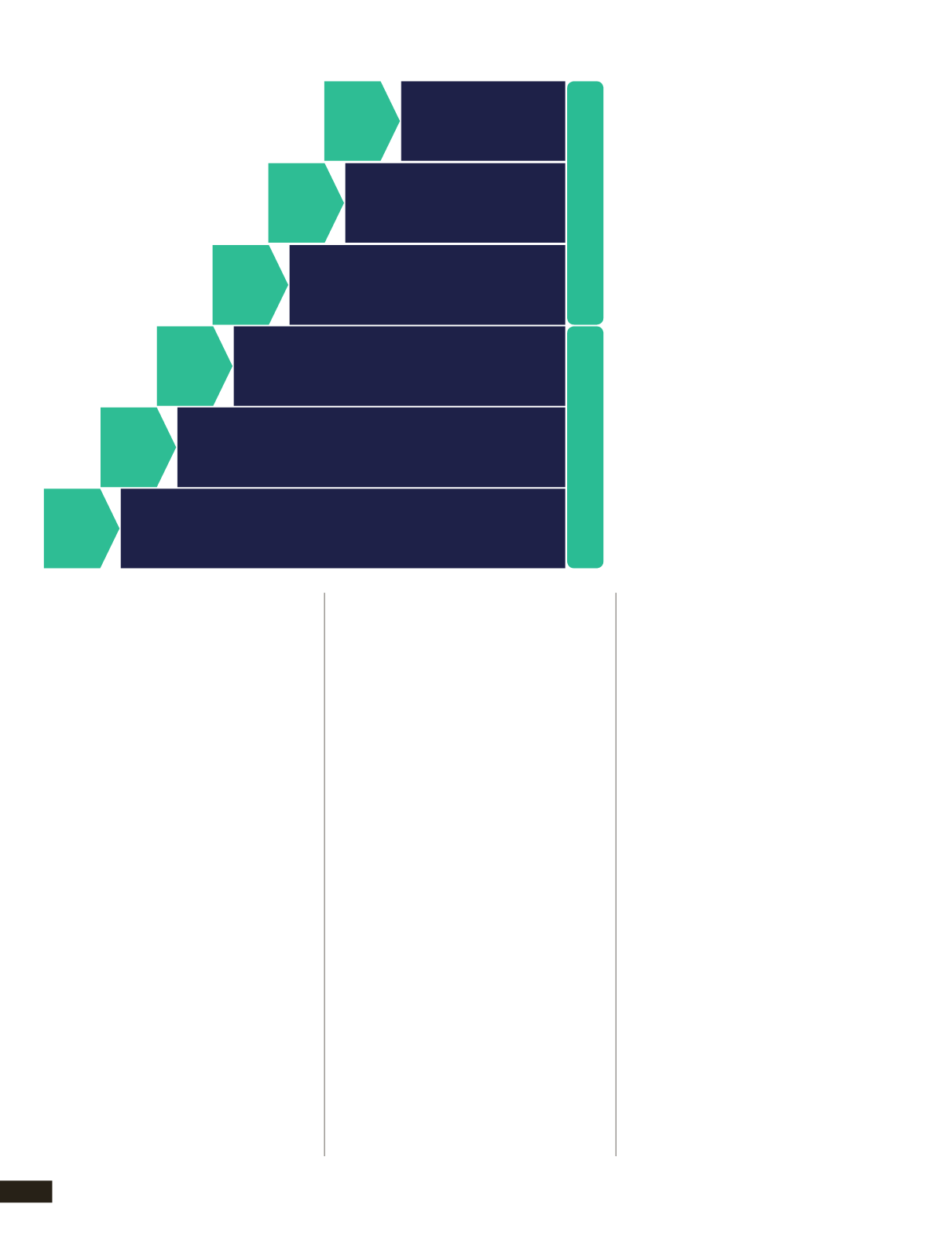

An adapted version of Bruce Temkin’s

“Five Stages of Experience-Based

Differentiation Maturity Model” is a nice

reference point to explain how UX as a dis-

cipline matures within organizations and

why now is the time for market researchers

to enter into UX. At Stage 1: Unrecognized,

UX (or its derivatives of experience and

design) does not exist as a formal discipline

in the organization. It’s likely the leaders of

the organization have little awareness of the

discipline at all. At Stage 2: Interested, the

organization has awareness of the UX dis-

cipline and is intrigued with its promise of

improving end-user experiences and thus

making companies more competitive.

Hence, the organization funds UX

“toe-dippers.” This may include hiring one

lone UXer, hiring UX consultants to sup-

port specific initiatives, or a combination of

the two. At Stage 3: Invested, companies

become more supportive of UX as a formal

discipline, resulting in internal UX teams

getting more properly staffed and the

department as a whole having objectives it

is accountable for. In Stages 2-3, UX work

is being used to provide directional points

on strategic initiatives (that are being

pushed down to them from other areas of

the company). Therefore, the rigor with

which this UX work is being executed—

and particularly the research behind the

UX design work being done—is often not

questioned. Additionally, much of the work

completed is still very tactical in nature.

The need for rigor and strategic thinking

elevates as organizations cross into Stage 4

of the UX Maturity Model. At Stage 4:

Committed, UX becomes a critical piece of

the organization’s competitive strategy. The

high-level executives of the organization

become actively involved in the UX team

and its work. This exposure results in the

team offering strategic input into the initia-

tives of the organization versus tactically

executing on the strategy handed to them.

As an organization progresses into Stage 5:

Engaged, UX is perceived to be a core tenet

of the organization’s strategy. It is a formal

department, equally valued and respected

as any other functional role in the organi-

zation, such as Sales, Marketing, R&D, etc.

And, finally, once an organization reaches

Stage 6: Embedded, UX is no longer per-

ceived to be a discipline or functional role

on its own. Rather, UX and its user-centric

philosophies are a mindset embodied by

every employee working within the organi-

zation, irrespective of the functional role

they personally perform for the organiza-

tion.

What’s happening in the UX discipline

right now is that Fortune 1000 companies

that have embraced UX as a competitive

strategy are making the leap from Stage 3:

Invested to Stage 4: Committed. As that

jump is occurring, the research practices

of UX teams—currently owned by user

researchers—are coming into question,

particularly related to participant sample,

participant quality, and method breadth.

From a participant sample perspective,

it’s typical for user researchers to advocate

for fewer numbers of research participants,

stating that the in-depth learning gained

via ethnography with eight people, for

instance, mitigates the need for collecting

a breadth of perspectives on that particular

topic. Bottom line, once research starts

informing strategic direction, sample sizes

of eight no longer cut it. Market research-

ers have insight into the qualitative and

quantitative sample sizes that sufficiently

support strategic insight and frankly feel

right to company executives.

From a participant quality perspective,

it’s not uncommon for user researchers,

particularly operating in Stage 2 of UX

maturity, to use other people in the com-

pany or family and friends as their

research sample. Market researchers are

trained to openly acknowledge and work

around sampling biases. This is rarely a

conversation had between user research-

ers operating in Stage 2 and 3 of UX

Why Now – More than Ever – Market Researchers Should Consider UX

CONT INUED

The Evolution of UX:

How UX takes hold

within organizations ...

The User Experience Maturity Model,

Adapted from Bruce Temkin’s

Five-Stages of Experience-Based

Differentiation Maturity Model

1

2

3

4

5

6

EMBEDDED

UX is in the fabric of

the organization, not

discussed seperately

ENGAGED

UX is one of the core tenets of

the organization’s strategy

COMMITTED

UX is critical and executives

are actively involved

INVESTED

UX is very important and

formalized programs emerge

INTERESTED

UX is important, but recieves little funding

UNRECOGNIZED

UX is “not important”

UX used to enable strategic growth

UX used as a directional point